5 More New Features Of Our Digital Banking Suite

We’re very excited for the launch of our New Digital Banking Suite at the end of October, 2017. This is part three of a three part series. Today we will release five new and exciting features our new Digital Banking suite will provide you with. We hope you are as excited as we are for the launch.

5 New & Exciting Digital Banking Suite Features

- Send Money To Others

Our new Digital Banking Suite will allow you to send money to others. Even those who do not have an account at Launch CU. Simply use the “Send Money” page to send money to those who have an account elsewhere.

- Set Advanced Alerts & Choose How You Receive Them

Our Digital Banking Suites allows you to create alerts to notify you when certain activity takes places on your accounts. These account alerts include:

| Type | Description | |

|---|---|---|

| Alerts | Date Alerts | Reminds you of a specific date or event such as a birthday, anniversary, or vacation. |

| Account Alerts | Notifies you when the balance in one of your Launch CU accounts drops below or rises above a specified amount. | |

| History Alerts | Notify yourself when a specified check number posts, a debit or credit transaction is greater or less than a specified amount, or a transaction description matches text that you specify. | |

| Online Transaction Alerts | Notify yourself when a check reorder, external transfer, funds transfer, or stop payment is initiated. |

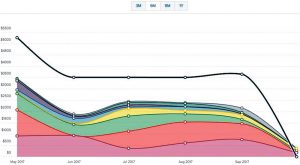

- In-Depth Money Management

Our Personal Finance Manager will provide you with widgets to help you understand where your money is going, and how much you are saving.

~ The Budget Widget: Allows you to set budgets for each spending category and track your progress towards those categories each month.

~The Net Worth Widget: Tracks the net sum of all your assets and liabilities over the past year.

~The Spending Widget: Helps you track where you’re spending your money. Separates your transactions into categories.

~ The Trends Widget: Shows spending history by category, along with a green line showing your income. This will help you determine if you are spending more than you’re making.

~ The Debts Widget: Allows you to see all of your debt accounts in one place, and helps you calculate how making additional payments, or paying off your debt completely can impact your debt over time.

- Leave A Comment On A Specific Transaction

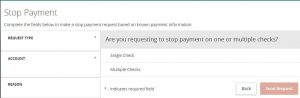

Our new Digital Banking Suite will allow you to send and receive secure messages from Launch CU about a specific transaction. Simply click or tap on the transaction, then click or tap on the speech bubble. - Stop Payment

With our new Digital Banking Suite, you can request a stop payment on one or multiple checks in a matter of minutes right from your dashboard.

Bonus Feature: Help Center

Our in-depth Online Help Center will help you get the most from your Digital Banking experience. The easy-to-navigate table of contents, along with search bar make finding what you’re looking for easy. The Online Help Center can be found on the main navigation menu.

Previously Released Features

- Seamless Design Regardless Of Device Used

- Forgot Password Capabilities

- Ability To Find What You’re Looking For Fast

- Finance Manager Tools

- Send & Receive Secure Messages

- Self-Enroll From Any Device

- Customization

- Linking External Accounts

- Pre-Populate Your Information Into A Web Loan

- Easy Account Management