7 Tips For Donating to a Charity

Updated: August 16, 2023

With technology today, unfortunately, there are several bogus donation links shared via social media and scammers calling pretending to be from charity organizations. If and when you decide to support a cause, you want your donation to count. For your financial well-being, we wanted to share some tips you should consider when donating to a charity to avoid scams.

Choose a cause you care about

Whether it’s a cancer charity, child hunger, animal charity, or disaster relief charity, your first step is to find what cause you are most interested in helping. From there, it’s recommended you research the best cause to donate to. You can do this by searching for your cause of interest and the phrase “best-rated charity” (for example, “Hawaii Wildfires Relief best-rated charity”).

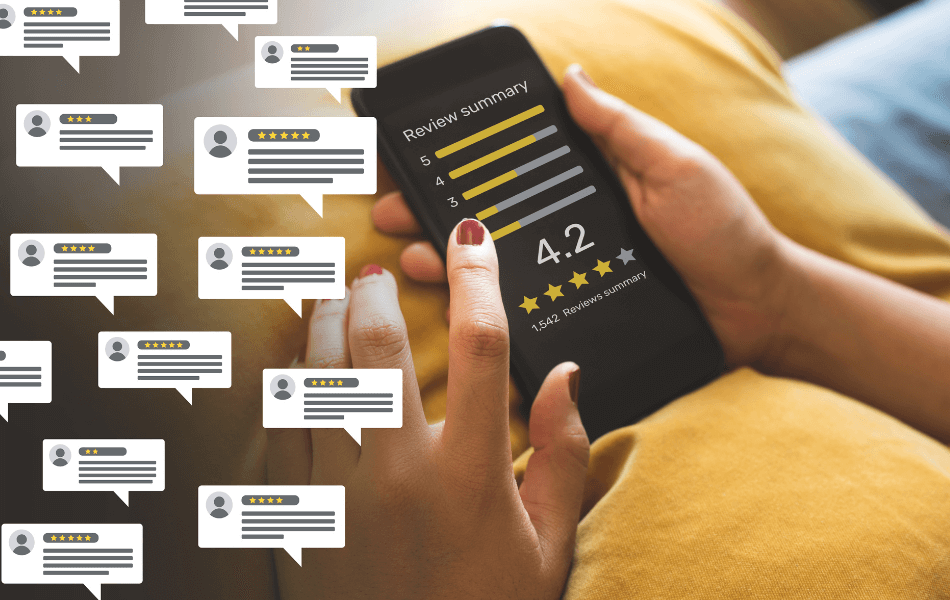

Know your charity

Never give to a charity you know nothing about. Once you find a specific charity you are interested in, it’s suggested you search the charity’s name followed by “complaint”, “review”, “rating”, or “scam”. Review red flags, if applicable, and decide if you want to move forward. In addition to searching for complaints, reviews, ratings, and/or scams regarding your chosen charity organization, you will want to know where your dollars go. Charity Watch recommends that in most cases 60% or more of your charitable donation should go to program services. The remaining percentage, ideally less than 40%, is spent on fundraising and general administration”.

“Tax exempt” doesn’t always mean “tax deductible”

It’s important to note that not all charities soliciting for ‘good causes’ are eligible to receive tax-deductible contributions.“Tax exempt” means the organization does not have to pay taxes and “Tax deductible” means that if you donate, you can deduct the contributions to the charity on your federal income tax return. You can visit the Tax Exempt Organization Search on the IRS website to determine if your donation would be tax deductible.

Don’t fall victim to solicitation

This may sound familiar to you. Someone contacts you asking for a donation. It sounds like a group you’ve heard of and you want to help. How can you tell if it’s a scam? Often times, the person won’t take “no” for an answer. They may even pressure you to donate right away. A legitimate charity will not pressure you. If you are unsure, ask the fundraiser for the charity’s exact name, website, and mailing address so you can research the legitimacy. Trust your gut. This leads to our next tip…

Give directly

There are many scammers claiming to represent charities that work locally; they can even change their caller ID to look like they are calling from a local area code. If you come in contact with someone claiming this, you may want to contact the local organization to ask if they work with or know about the charity. In order to avoid a possible scam through a third-party website or a middleman, it’s suggested you give directly to the organization to ensure the entire donation will be donated and a portion won’t be given to the middleman.

Only give through a reputable and secure service

Once you are ready to donate, you need to be careful about how you pay. NEVER give cash, pay by gift card, or wire money; that’s how scammers ask you to pay. Paying by credit card or check is the safest. If you are donating online, make sure you are on a reputable and secure website.

Keep records of your donations

After making a donation, be sure to take a screenshot of your confirmation. In the case that you don’t receive a confirmation email, this will be your proof of donation. It’s also recommended that you monitor your bank account to ensure the correct amount is withdrawn; nothing more than what you agreed to donate.

It’s important that you are aware of potential scams and research the charity before you decide to make a donation. Don’t let the scammers deter you from making donations to legitimate charities; there are many worthy organizations that are in need of donations.

Remember, if you see any red flags, or if you’re not sure about how a charity will use your donation, consider giving to a different charity. You can also report any scams you encounter to FTC.gov/complaint.

For additional help, turn to the following organizations for your research: BBB Wise Giving Alliance, Charity Navigator, CharityWatch, and GuideStar.