How to Avoid Bad Check Scams

Bad check scams are a popular way for scammers to trick people into sending them money. Thousands of fake check scams are reported each year according to the Federal Trade Commission. A fake check scam involves a scammer sending someone a checking and asking for money back. These can include car wrapping, selling items online, and secret shopper opportunities. Launch investigates how to avoid bad check scams so our members can avoid them.

Launch’s Information Security Officer, Jennifer Young, monitors these scams daily and says they’re becoming more popular. She says scammers continually find new ways to initiate these scams.

What are the different scenarios scammers use?

- Legitimate ways of earning additional income offered.

- Someone offers to buy a product you’re selling online.

- Someone requests taxes and fees in advance for a sweepstakes you magically won without entering.

How are these scams initiated?

- Ads are paced on popular job sites, social media, or at public venues.

- Scammers will call, text, or email you. They will also use messaged boards and social media to private message you.

How does the scam work?

- A job or prize is offered quickly and easily. Sometimes the victim doesn’t remember applying.

- The victim receives a check over the amount.

- The check comes with instructions that may state the person is to keep the amount agreed upon for payment, and send the rest back via wire transfer, gift cards, or cash.

- A bank discovers the deposited check is bad, consequently leaving the victim stuck paying back the bank.

- The scammer already has the money sent by the victim.

What are the indicators of a check scam?

- The scammer is eager to close the deal quickly.

- Payment is above normal asking price and/or industry standard.

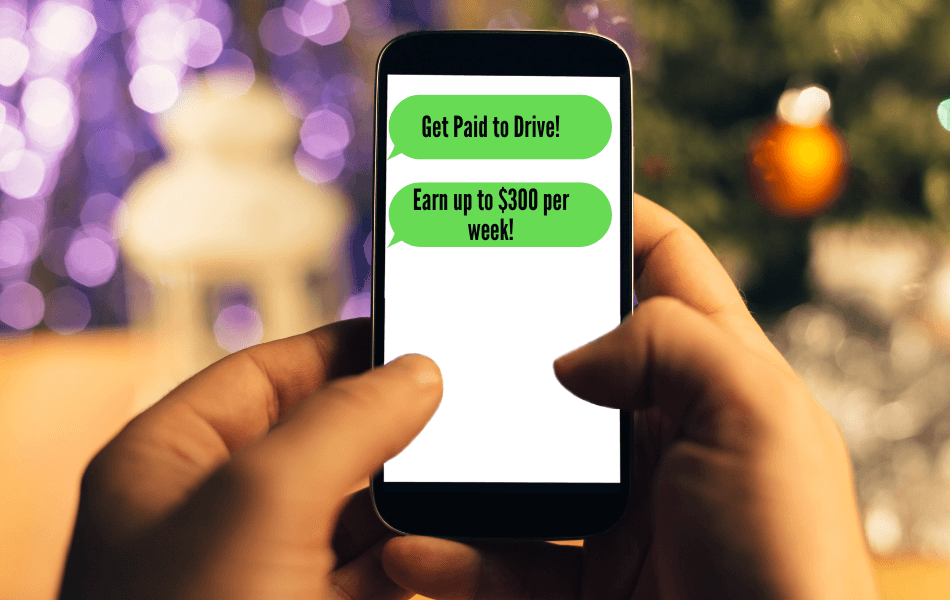

Young says a popular scam right now is car wrapping, which is especially popular with college students. Car wrapping is a way for businesses to advertise upcoming events or products. The scam usually starts in the form of a text or call offering students to “Get Paid to Drive” for a payment of $250-$300 per week.

How Do Car Wrap Scams Work?

- Students are sent a check to pay a specific specialist to wrap their car.

- The specialist requires them to deposit money directly into their bank account or send a money order because these funds are hard to cancel.

- The student keeps the rest of the funds as payment.

- Deposited check funds are put on a hold and the scammers know when this hold will expire.

Young says these holds often expire before the check is returned as bad, consequently leaving the student responsible for the amount of the bad check.

If you would like more information on bad check scams, visit the Federal Trade Commission’s Consumer Information Blog and Fraud.org’s Fake Check Scams. In addition, check out Launch’s blog to learn more about different scams.